As we turn the page to a new year, I’m curious what new words or phrases will become a part of our vocabulary in 2024. It always amazes me how terms that were either rarely used or had never been uttered all of a sudden become top-of-mind in a given year thanks to a cultural phenomenon or a sudden change in branding by a guy named Mark or Elon. Prior to 2020, for example, how often did words like quarantine, zoom, or social distance get spoken? And in 2021 we all learned about the Metaverse. In 2023 there were a number of words and phrases that became commonplace, from spy balloon to Coach Prime to X (in place of Twitter) or Traylor (as in Travis and Taylor). And while all of these had a cultural impact, there were a few others that impacted the world of finance in a profound way. This month I’d like to highlight a few of these and look at their impact moving forward.

AI – While Artificial Intelligence (AI) dates back to the 1950s and more recently in technologies such as Alexa and Siri, AI saw a significant uptick in activity in 2023, due in large part to the introduction of ChatGPT. AI enthusiasm reached fever pitch levels in 2023 with mega-cap stocks such as Microsoft, Apple, and Google expecting significant growth through investments in the technology. But beyond the tech stocks, companies such as The North Face, Wells Fargo, and Walmart have implemented machine learning in a variety of ways. A Market Intelligence review of S&P 500 transcripts found nearly 2500 mentions of AI during earnings calls in 2023. Expect this technology to continue to impact economic activity in a meaningful way.

ChatGPT – Launched by San Francisco-based Open AI in late 2022, Chat GPT is an AI chatbot that uses language processing tools drawn from a robust amount of data to formulate human-like responses for any number of applications from building a travel itinerary to creating a shopping list to match your meal plan to crafting a blog post (no, this one was not generated through AI!). GPT stands for Generative Pre-trained Transformer. ChatGPT is trained with reinforcement learning through human feedback and reward models that rank the best responses, which in turn should help create more accurate future responses. The generative AI platform reached 100 million users in a mere two months, so the appetite for this type of technology is clearly there.

The Magnificent Seven: Many companies are making significant bets on productivity gains through Generative AI technologies such as ChatGPT, and arguably the investment and growth anticipated from AI was one of the biggest components of the exceptional return of more than 75% for the “Magnificent Seven” stocks in 2023. These magnificent names, as coined by Bank of America’s Chief Investment Strategist Michael Hartnett, include Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla. These 7 stocks now make up approximately 30% of the total valuation of the S&P 500, the largest allocation to the top 7 stocks ever for the index.

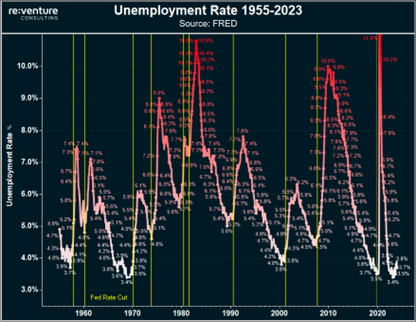

Soft Landing – While the Magnificent Seven continue to thrive, the real question the markets face this year is whether or not the Fed can navigate the “soft landing” they desire in their attempt to curb inflation through interest rate hikes. While inflation seems to have subsided in some areas, the affordability of housing remains a concern with rates still north of 7% and listing prices well above 2021 levels. Unemployment typically spikes three months after initial rate cuts. At the moment we’ve yet to see any real movement in unemployment with the rate hikes. In fact, the US added 216,000 jobs in December and unemployment held steady at 3.7%. There is a big assumption for a soft landing to occur that we don’t see that historical spike in unemployment as we’ve seen during past easing environments. I’m still somewhat skeptical that the landing won’t come without a few bumps along the way.

Finally, it’s an election year. And we’re bound to have a debate gaffe or insult that becomes the phrase of the day, but hopefully at the end of the election year we can all feel good about what we’re saying as it relates to market returns. While election years can bring uncertainty it’s worth noting that historically, election years have been good for the market. The average return of the S&P 500 in the last 16 presidential election years is 10.5%. If you remove the only two of those 16 years when the market was negative (the global financial crisis and the dot-com bubble), the S&P 500 gained an average of 15.3%. So, what magnificent phrase or words will rule in 2024? Could it be AI Bubble? Or Crash Landing? Or perhaps the Fortunate 493? We look forward to navigating the road ahead with you and the words and phrases that become commonplace in 2024, and we appreciate the trust you’ve put in us in trying to translate it all!

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Kent Oliver and not necessarily those of Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material and is not intended as a solicitation or an offer to buy or sell any security referred to herein. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur profit or loss regardless of strategy selected, including diversification and asset allocation. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Raymond James is not affiliated with nor sponsors or endorses any of the aforementioned organizations or individuals.