Is it too early for a presidential election blog?

We are now just five months away from the 2024 presidential election, and starting to get questions about how the stock market may perform under different scenarios.

Let’s start with interesting trivia. This isn’t the first “election re-match” between candidates, but it’s pretty rare, most recently happening in 1956 when Dwight D. Eisenhower and Adlai Stevenson faced off in consecutive elections. Eisenhower won both.

This rematch will be particularly notable if Donald Trump wins re-election. The last president to win non-consecutive terms was Grover Cleveland (22nd and 24th president 1885-1889 & 1893-1897), who defeated the incumbent candidate Benjamin Harrison for his second presidential term.

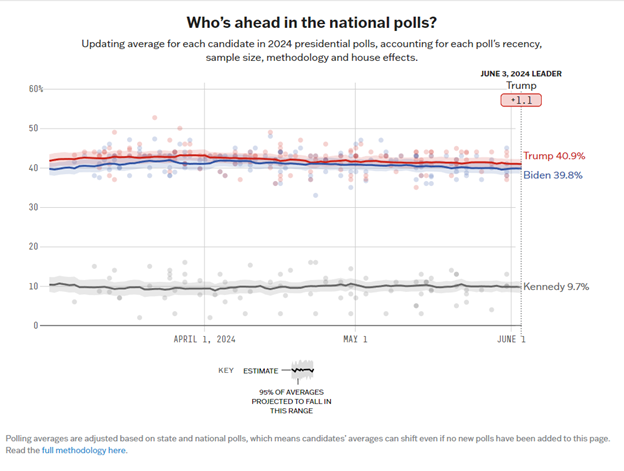

Who has the lead?

As of the end of May, Donald Trump has a narrow lead of 1.1% according to data from FiveThiryEight.com (as of June 3). Note – this polling data was compiled in late May. It remains to be seen how Trump’s legal woes may impact voters.

What will move the needle for voters?

In 1992, James Carville, a political strategist made a keen observation when he coined the term, “It’s the economy, stupid”. Perhaps that should be modified to “It's the stock market, stupid… and voters have a short memory”.

The performance of the S&P 500 in the three months before election day has an amazing track record of correctly forecasting the election winner. When stock market returns are positive, the incumbent party usually wins. If the market is down near election day, the incumbent generally loses.

Prior to the last election, the three-month performance in the market had correctly predicted 87% of elections since 1928. You could make a case that this simple predictor failed in 2020, but it’s worth an asterisk in the history books. Technically, the S&P 500 was up slightly from August 2 – November 2, (0.49% by my math… data from Yahoo! Finance), but Trump lost his re-election bid. However, 2020 was one of the most volatile years in the history of the stock market. If we shorten the time horizon a bit, we see that the stock market was actually down 7.5% in the two months before election day.

Morningstar research conducted their own study based on the year-to-date performance of the market in election years (rather than just the three months prior to election day) and found similar results. Based on the historical correlations and the year-to-date performance of the Dow Jones (through May 25th), Morningstar puts Biden's odds of re-election at 58.8%. Obviously, those odds will be strongly correlated to the stock market performance between now and election day.

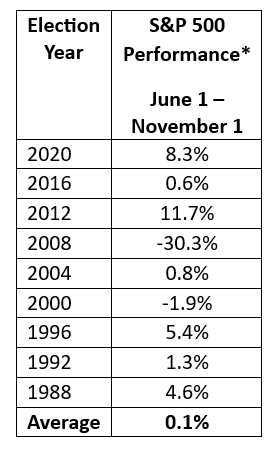

Election year summers

So, how does the market typically do in the summer of election years? Flip a coin.

*Calculations done by Brady using historical day-end values for the Standard and Poors 500.

The average return from June 1 – November 1 in the last nine election years is a whopping 0.1%, but that’s not without some drama. The S&P 500 fell more than 30% in 2008 from the “Great Financial Crisis” and rallied strongly in the summers of 2012 and 2020 on government stimulus hopes.

If we remove the pandemic of 2020 and the financial crisis of 2008, then we get an average return of around 3%, but let’s not cherry-pick our results. The point is that the performance of the stock market over the next 5 months is likely to have a tangible impact on voters when they go to the polls in November.

Which candidate would investors prefer?

Regardless of the outcome in November, the investment community knows what to expect from either candidate should they win re-election (in terms of policy goals), and the stock market has done well under both candidates (barring a meltdown over the next 5 months).

Both candidates had economic struggles during their time in office. Trump’s presidency was clouded with the economic uncertainty stemming from COVID, while Biden’s time was clouded with inflation as a result of the COVID stimulus checks and supply chain issues. Aside from the oddities surrounding COVID, both candidates can make a case that the economy was strong under their watch with low employment, strong economic growth, and growing corporate profits.

The economic policy goals of Trump and Biden are both pretty well known. Biden will support clean energy while Trump chants ‘drill, baby, drill’. Both have dramatically different approaches to health care, with Trump wanting to repeal the Affordable Care Act (aka ObamaCare) and re-shape healthcare. Trump also wants to repeal certain banking regulations while Biden views those as basic consumer protection (it’s complicated and nuanced). While they don’t agree on much, both appear to have similar ‘protectionist’ views towards China and favor imposing tariffs on Chinese goods.

The more regulated sectors of the economy (healthcare, energy and banking) tend to be the most impacted areas by presidential elections. The rest of the market (technology, real estate, industrials, etc) tends to be much more driven by consumer spending and the economic cycle, rather than regulations imposed by a politician. During Trump’s term in office, the healthcare sector outperformed Biden’s tenure (cumulative return of 108% v 61%)*, but the banking sector did better under Biden (49% v 13%)*. Somewhat counter-intuitively, the energy sector did substantially better under Biden despite increased regulation (179% v -40%)*, which likely has more to do with supply and demand as oil prices rose more under Biden (a factor for which no president should get undue blame or credit).

It’s tough to make a strong case that the stock market performance will be markedly different under either president. And it’s a little difficult to make the argument that any sector of the economy would benefit directly from the election results. In reality, the President of the United States is simply one factor in a very complex sea of economic factors (interest rates, currency values, consumer preferences, recession cycles, pandemics, global wars, technological advancements, etc).

In either outcome, we expect corporations to continue to innovate and increase profits over the next four years. While we will certainly see a recession at some point, (possibly in the next four years) the economy has a history of recovering and the stock market has a history of strong performance under both political parties. As we’ve emphasized before, it’s generally a mistake to change investment strategies due to election outcomes or changing political regimes. That holds especially true for the 2024 election.

*Figures rounded for ease. Brady calculated the cumulative total-return for the banking, energy, and healthcare sectors respectively using the following respective day-end values for the following: Banking KBW Nasdaq Bank Index), Energy (Russell 1000 Energy RIC 22.5/45 Capped Index), and Healthcare (Russell 1000 Health Care RIC 22.5/45 Capped Index). The total return data is calculated from 11/8/20216 to 11/2/2020 for President Trump’s time in office and from 11/2/2020 to 5/31/2024 to calculate the returns during Biden’s time in office.

Any opinions are those of Brady Raanes and not necessarily those of Raymond James. This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Expressions of opinion are as of this date and are subject to change without notice. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein.

Investments mentioned may not be suitable for all investors. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.