For the first time since 2020, the Feds cut interest rates. This wasn’t surprising, but the .50% cut was larger than many predicted (there was only a 45% probability of a .50% rate cut the week before the meeting). The chart below shows the latest market expectations for the Fed Funds Rate. What does this mean for stocks, bonds, real estate, and commodities? Let’s briefly look at each.

Bonds are probably the most predictable asset class on the list. Rate cuts have historically translated into solid returns for bonds. It’s just basic math when it comes to bonds. If an investor owns a bond with a 5% yield and comparable bond yields fall to 3%, then the 5% yielding bond is more appealing to other investors and the bond price should appreciate. Assuming bonds don’t default on their payments, falling interest rates should translate into higher bond prices and attractive returns. Disclaimer: not all bond yields will necessarily decline when rates decline and not all bonds behave the same due to credit quality and type of bond (government, corporate, MBS, etc.).

Stock market performance is a mixed bag after rate cuts. Stocks fell dramatically following rate cuts in 2000 and 2008, but there are plenty of examples where rate cuts didn’t precede a dramatic market decline (1980, 1984, 1989, 1995). Regardless, it’s important to remember that the Federal Reserve is cutting rates over concern for a weakening economy. Inflation fear appears to be in the rearview mirror (for now), and the Federal Reserve is now focused on minimizing potential job losses and avoiding a deep recession. While investors may celebrate the rate cuts, the potential offset of a slowing economy isn’t always a winning formula. Add in the uncertainty of an election and it’s essentially a coin flip for stock prices.

Commodities tend to benefit from falling rates all else equal, unless the economy weakens more rapidly or dramatically than expected. As rates decline, the US dollar should weaken (in theory, at least). A weaker US dollar tends to increase commodity prices in US dollar terms. In an extreme scenario, higher commodity prices could re-stoke the embers of inflation, but again… it’s worth remembering that any benefit from rate cuts could be offset due to a slowing economy. If job losses rise and consumption declines, commodity prices may weaken. Much like stocks, commodities prices are a coin flip following rate cuts.

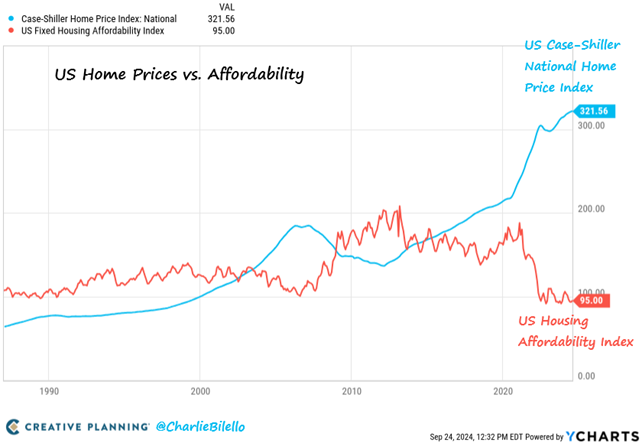

Real Estate may be the most interesting asset class over the next year. Home prices remain high; as do mortgage rates, which has led to some of the worst housing affordability on record. Affordability should improve when mortgage rates decline and could lead to a flood of activity.

Part of the reason for the continued price appreciation of residential real estate is an extreme lack of supply. Few homeowners are willing to sell an existing home with a 3ish% mortgage in exchange for a new home with a 6ish% mortgage. The dramatic rise in interest rates from 2022-2023 effectively “trapped” homeowners for the last 2+ years.

As indicated in the chart above, recent home sales are less than the COVID low and rival the depths of the 2008-2009 Great Recession caused by the bubble in real estate. Many looking to buy and sell real estate are simply waiting for rates to decline. After all, why lock in a 6% mortgage now if rates are expected to be lower a year from now?

We expect a notable uptick in activity as mortgage rates decline. On the surface, this is a good thing (lower rates = more affordable housing), but it could also mean that housing supply will outpace demand as “trapped” homeowners look for a change of scenery. If rates fall too quickly, it could even lead to a supply glut and eventually softer home prices and longer wait times for sellers due to the increased inventory on the market. Admittedly, we are miles away from that scenario and it feels rather unlikely to play out over the next year.

Barring a recession that crushes demand or a sudden supply glut, real estate transactions (and prices) should benefit from lower rates. It will take a while before the current real estate market is considered a “buyer’s market” but lower rates are likely the first step in the equation.

As always, we appreciate any feedback, questions, or concerns. Thank you for your continued confidence and trust as we navigate these interesting markets.

Any opinions are those of Brady Raanes and not necessarily those of Raymond James. This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Expressions of opinion are as of this date and are subject to change without notice. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein.

The investments mentioned may not be suitable for all investors. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Investing involves risk and you may incur a profit or loss regardless of the strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.